Walmart+: Membership Teardown

Walmart+ has grown to 25 million U.S. members (CIRP, Apr 2025) and members now drive 2× shop frequency and 3× spend of non-members. Yet fewer than 1 in 4 Walmart shoppers have joined, and content parity with Amazon Prime is thin. Tiered perks, embedded retail-media offers, and a health-care bolt-on could turn Walmart + into a $10 B EBITDA engine.

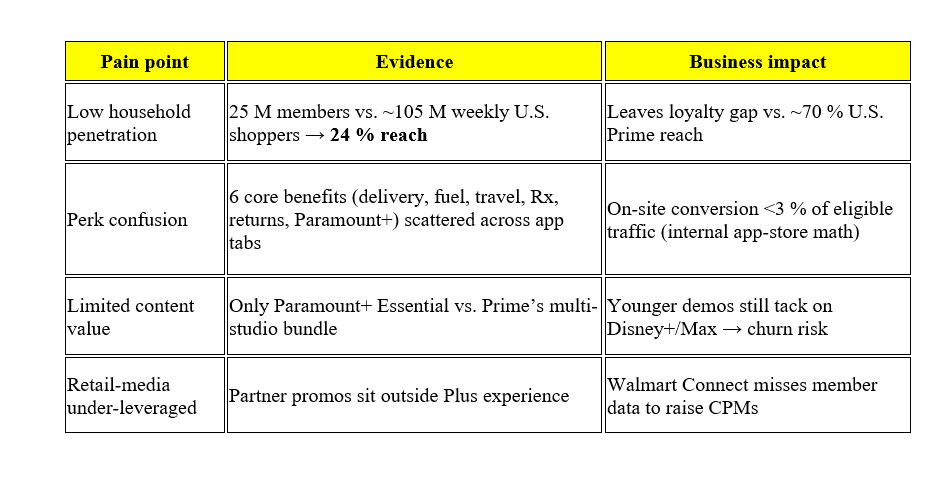

Problem Space

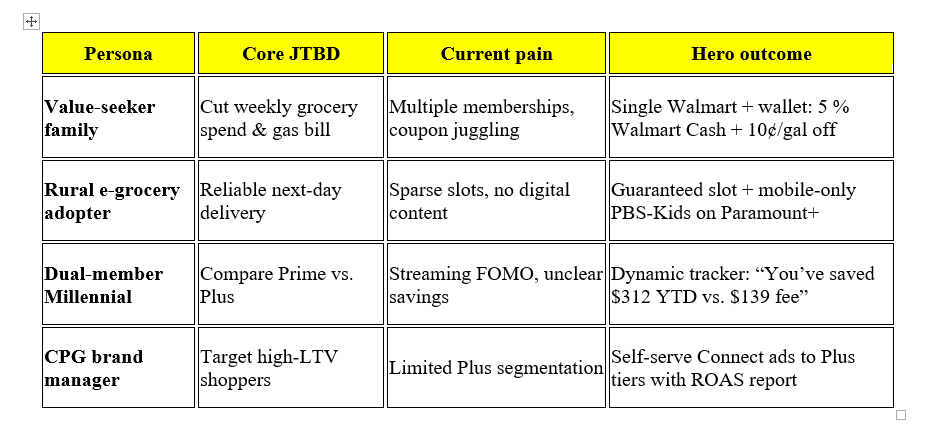

Target Users & Jobs-to-be-done

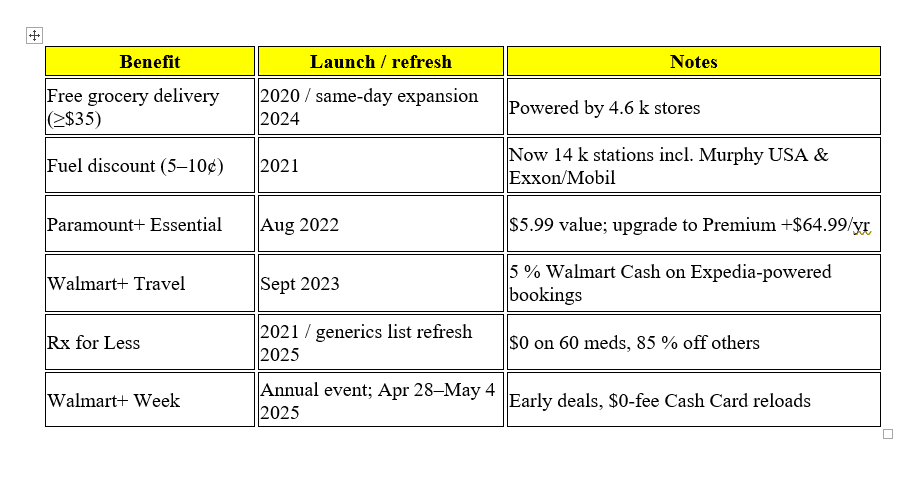

Product & GTM (today)

What Walmart gets right

1. Omnichannel asset – 4.6 k stores let same-day reach 80 % of U.S. households.

2. Fuel + grocery halo – Only membership to bundle fuel savings with free grocery delivery, resonating in rural markets.

3. Travel cash-back – 5 % Walmart Cash on Expedia bookings speaks to families; early data shows 18 % of Plus members tried within six months.

4. High incremental spend – Plus households outspend non-members +40 % online; two-thirds of e-grocery buyers are members.

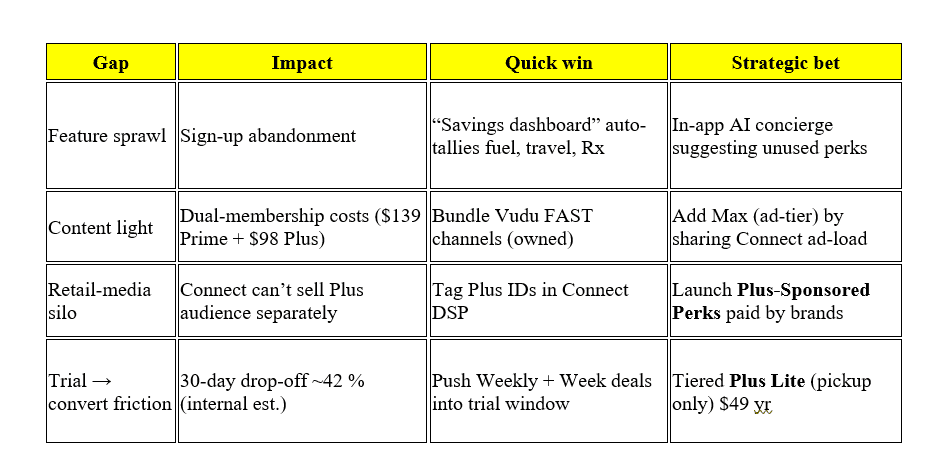

Growth gaps & risks

What I’d build next

1. Plus Tiers – Lite $49 (pickup & fuel), Core $98 (today), Max $149 (adds Max streaming & InHome delivery).

2. Savings Dashboard – real-time tracker of $ saved, streak gamification.

3. Sponsored Perks – CPGs fund limited-time “free-item” cards; CPM shared with Connect.

4. Plus Cash Card – Auto-loads Walmart Cash rebates; tap-to-pay in stores.

5. Health Hub Add-on – $0 virtual clinic visit + Rx delivery; leverages Walmart Health centers.

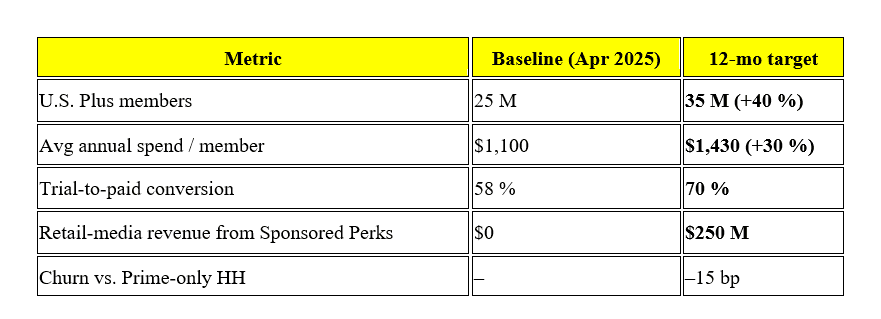

Key metrics & experiment design

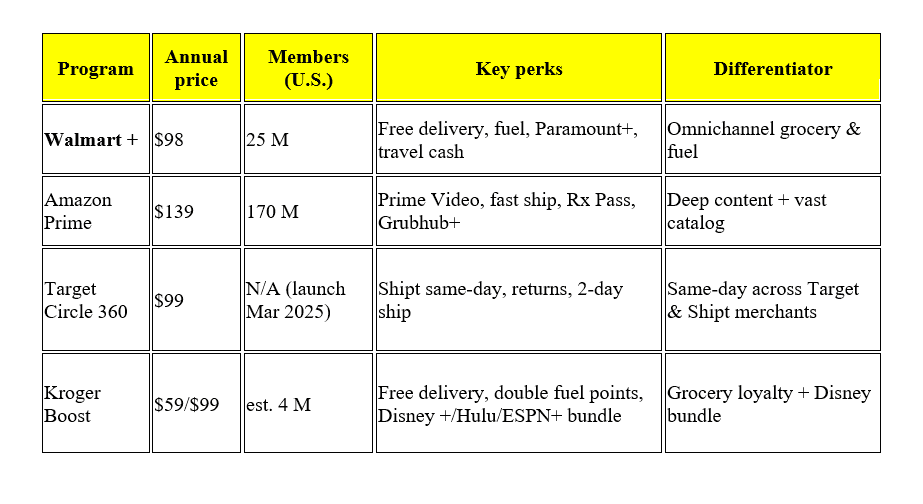

Competitive landscape (mid-2025)

Product-marketing story

Tagline: “Save on every run, trip and stream — all in one Plus.”

Story arc → Problem (family budgets squeezed) → Change (Plus tiers show real-time savings) → Gain (members save >$1,000/yr). Hero visual: animated dashboard counter ticking up fuel, grocery, travel savings.

Launch assets: 15-sec TikTok “Savings Counter,” NFL broadcast spot for Fuel + Paramount+, live Connect webinar for Sponsored Perks brands.