Visa Payment Passkey Service: Product Teardown 💰

Visa Payment Passkey Service

Why this matters

Online card-not-present (CNP) fraud is roughly seven times higher than in-store fraud, and each extra step at checkout drives shoppers to abandon carts. Visa’s new service replaces passwords and one-time passcodes with a FIDO-standard passkey that works across every modern browser and device. The shopper scans a face or fingerprint, a cryptographic signature is sent, and the issuing bank receives the same risk data it needs to approve safely.

01: Market Context

70 percent of mobile shoppers drop off when an SMS OTP arrives late.

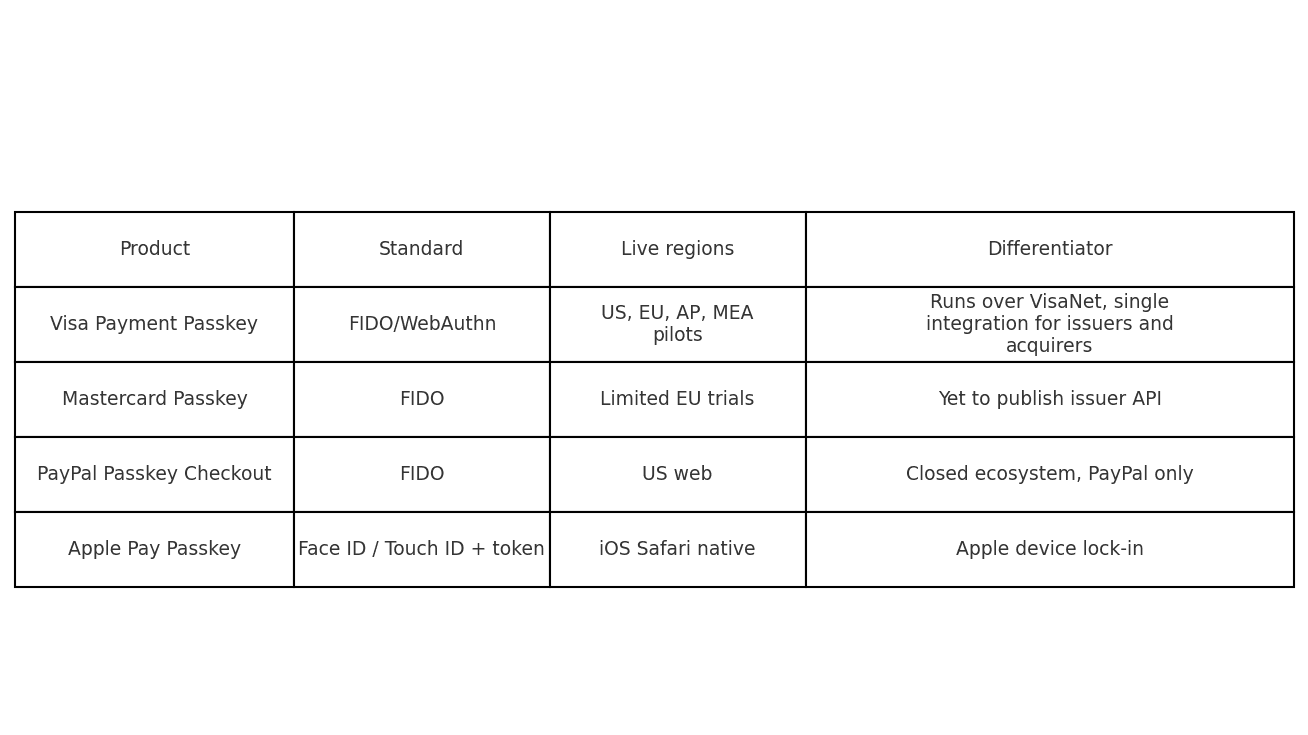

PSPs like Adyen and Stripe were first to switch on passkeys, giving instant reach to thousands of merchants.

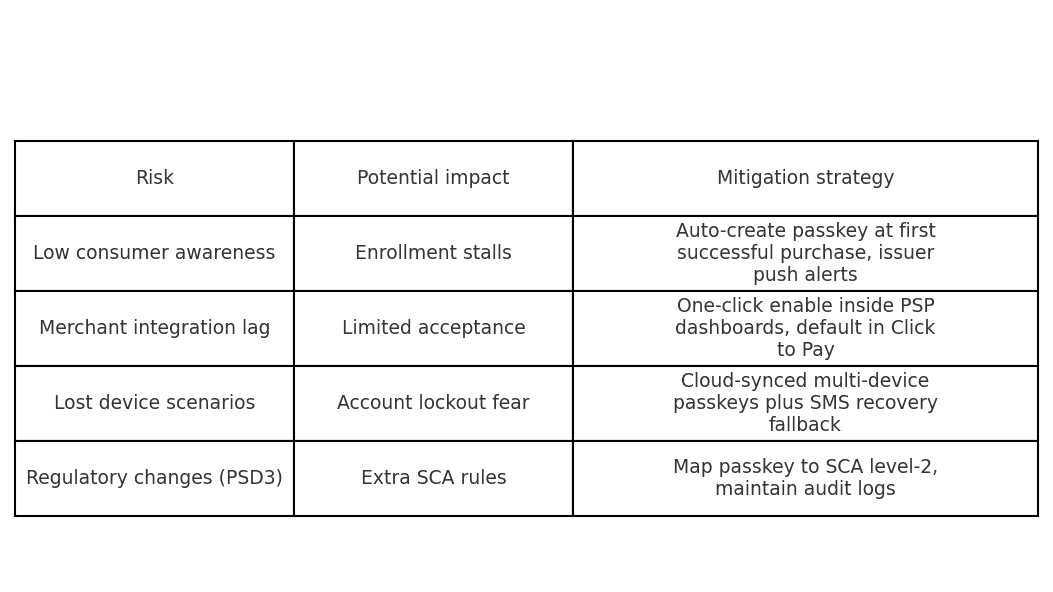

Regulators in the EU (PSD 3) and India (RBI tokenization) are pushing both stronger authentication and less friction, making a standards-based approach attractive to issuers.

02: Product Architecture

Enrollment – a passkey is created once, bound to a trusted device and synced in the customer’s iCloud Keychain or Google Password Manager.

Checkout – the merchant calls Click to Pay, Visa prompts for Face ID / fingerprint on the same page, and returns a FIDO signature plus a Visa network token.

Risk and decisioning – issuers still run their machine-learning models because the passkey payload nests inside existing 3-D Secure rails, so no back-end rebuild is needed.

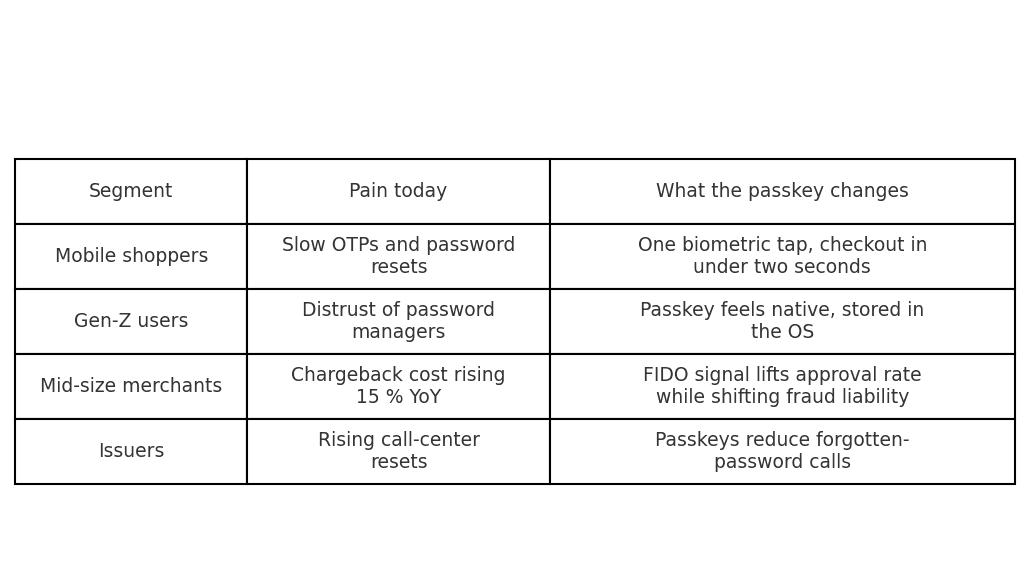

03 : User insights that shaped the MVP

Data sources: 20 merchant shadow sessions, 4 000 checkout screen recordings, call-log analysis across three regions.

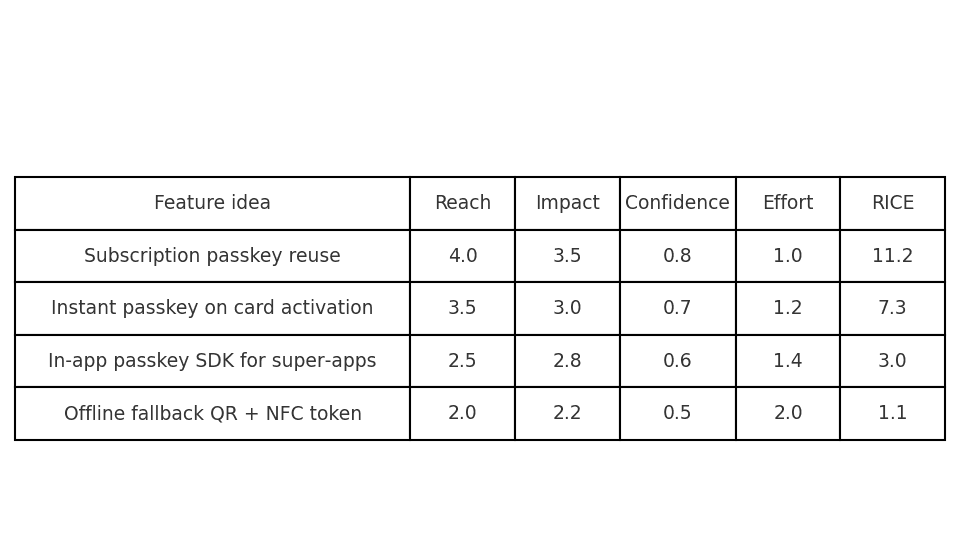

04: Feature prioritization (RICE) – next 18 months

Subscription passkey reuse wins because stored-card fraud and churn cost issuers the most today