Visa Flexible Credential: Product Case Study 💸

Visa Flexible Credential (VFC)

A Case Study

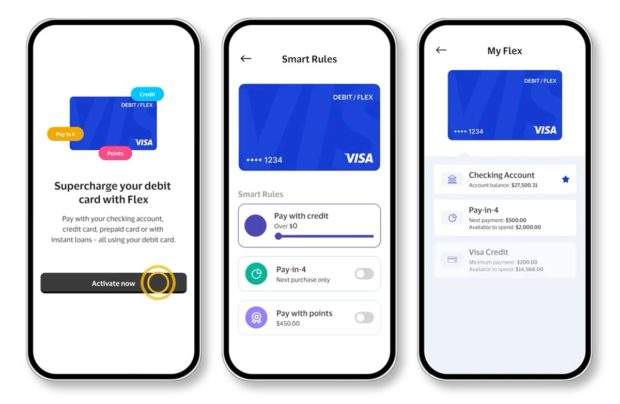

Visa’s Flexible Credential turns a single 16-digit PAN into a dynamic card that can route any given transaction as debit, credit, BNPL, rewards points or even multi-currency - chosen in real time by the cardholder inside the issuer’s app. The capability soft-launched in Japan and APAC in 2023 and went live globally in November 2024 with the Affirm Card in the U.S. and Liv Bank in the UAE.

Why it matters ?

Card-on-file overload: U.S. consumers average four open credit lines; juggling cards is painful and lowers issuer “top-of-wallet” share.

BNPL & debit converge: Gen-Z prefers debit for daily spend but wants instalments for bigger tickets; VFC lets them keep one credential.

Issuer economics: a single, always-approved credential lifts authorization rates and lowers the cost of issuing multiple plastics.

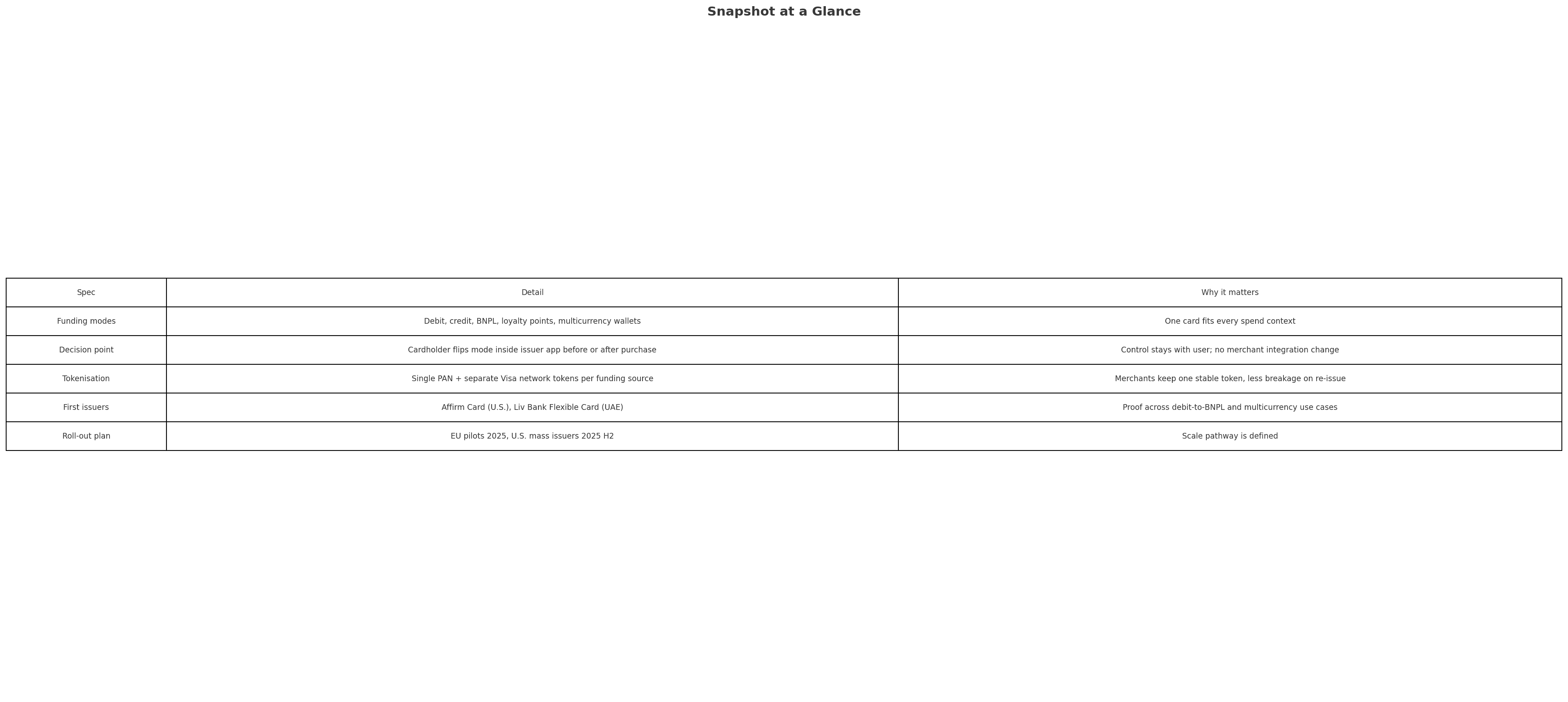

Snapshot at a Glance

Please click on the picture to zoom in !

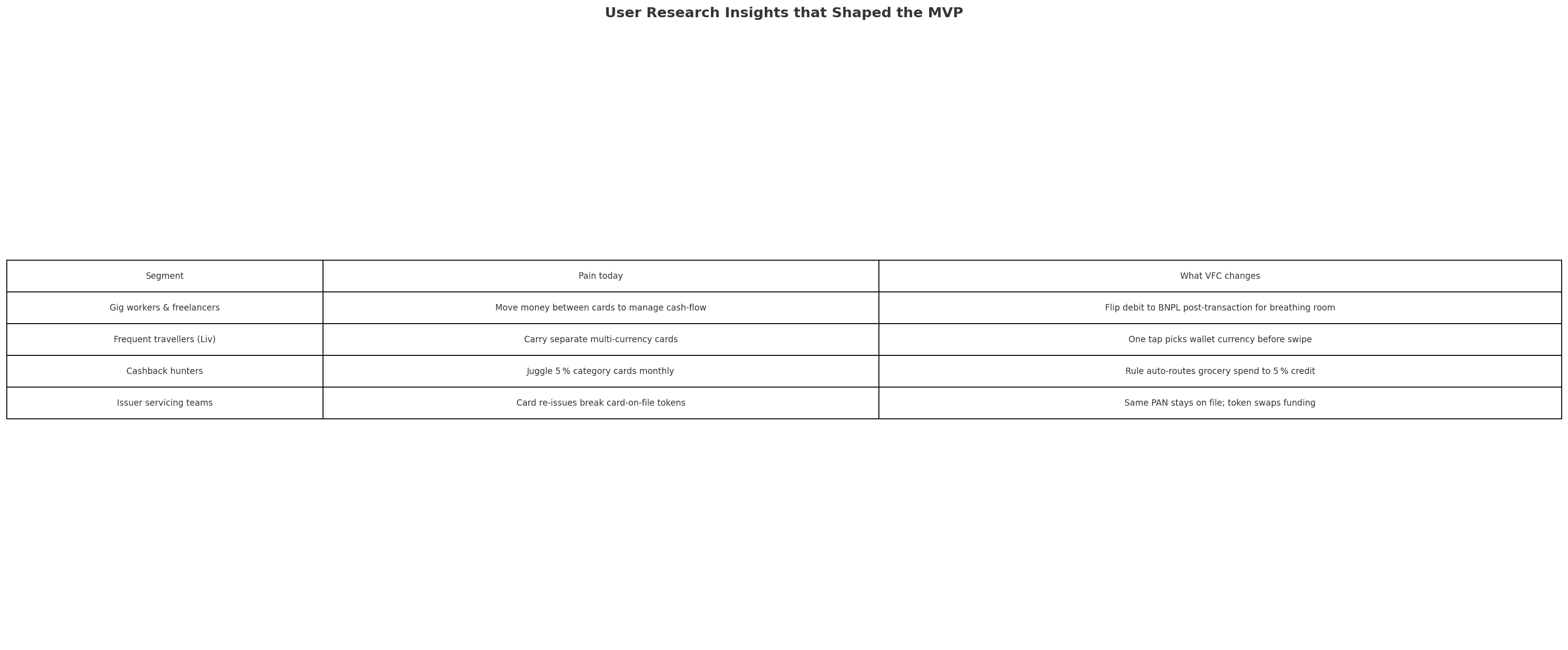

User Research Insights that Shaped the MVP

Please click on the picture to zoom in !

Problem Definition

How might Visa give cardholders dynamic payment choice without forcing merchants to re-integrate or issuers to launch multiple plastics - while preserving existing fraud controls and network incentives?

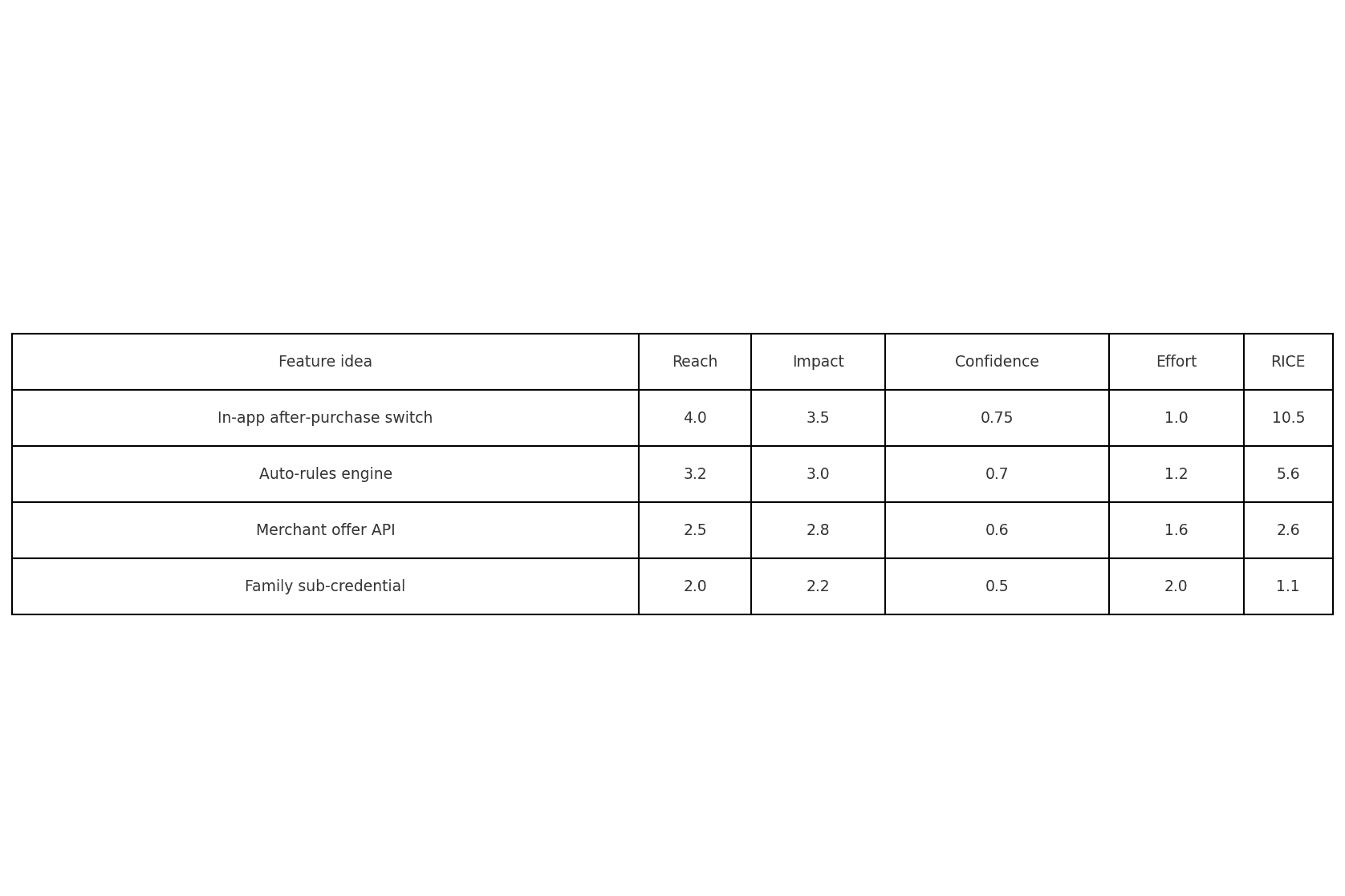

Feature Prioritization (RICE) – next 12 months

Please click on the picture to zoom in !

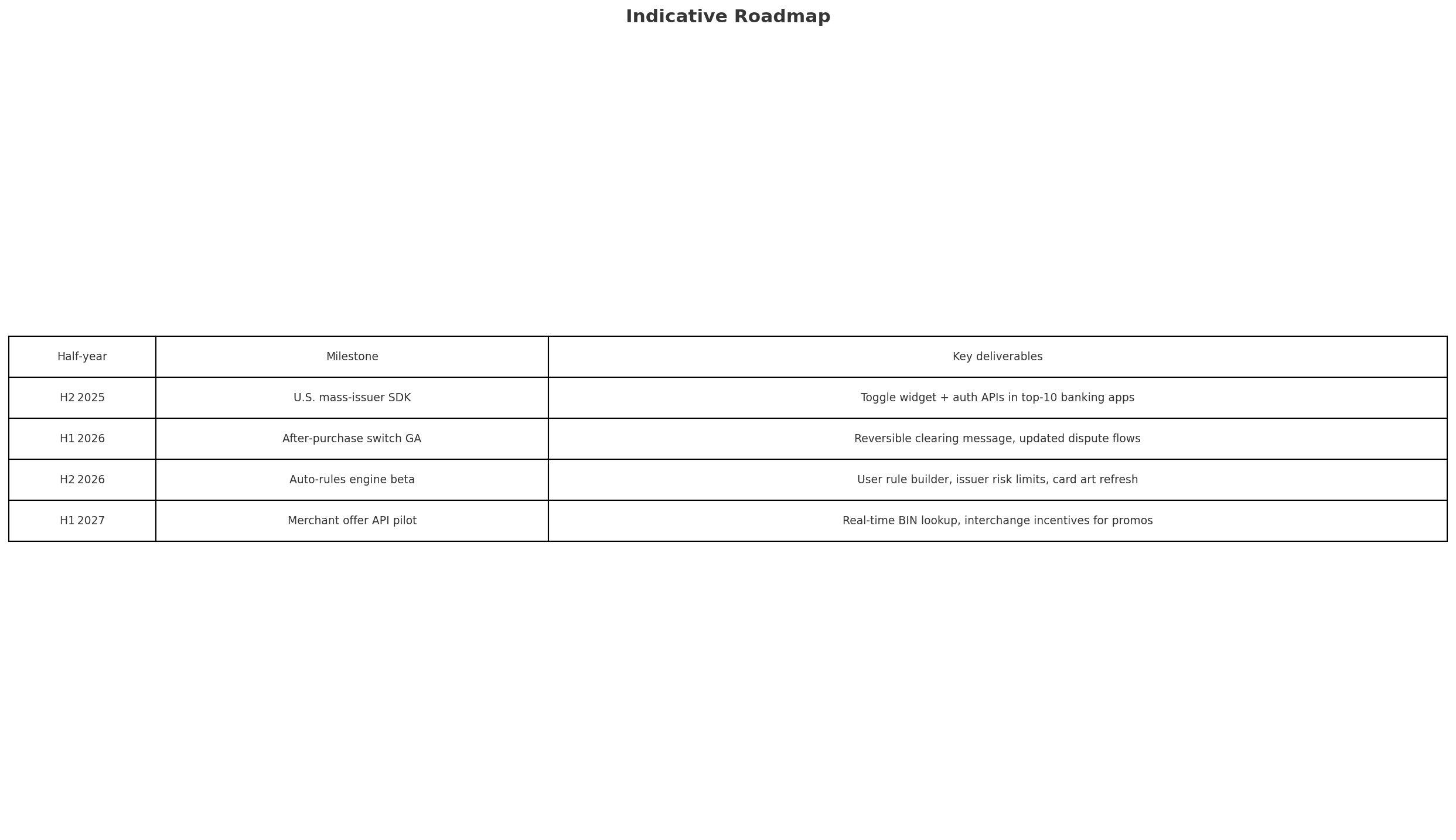

Indicative Roadmap

Please click on the picture to zoom in !

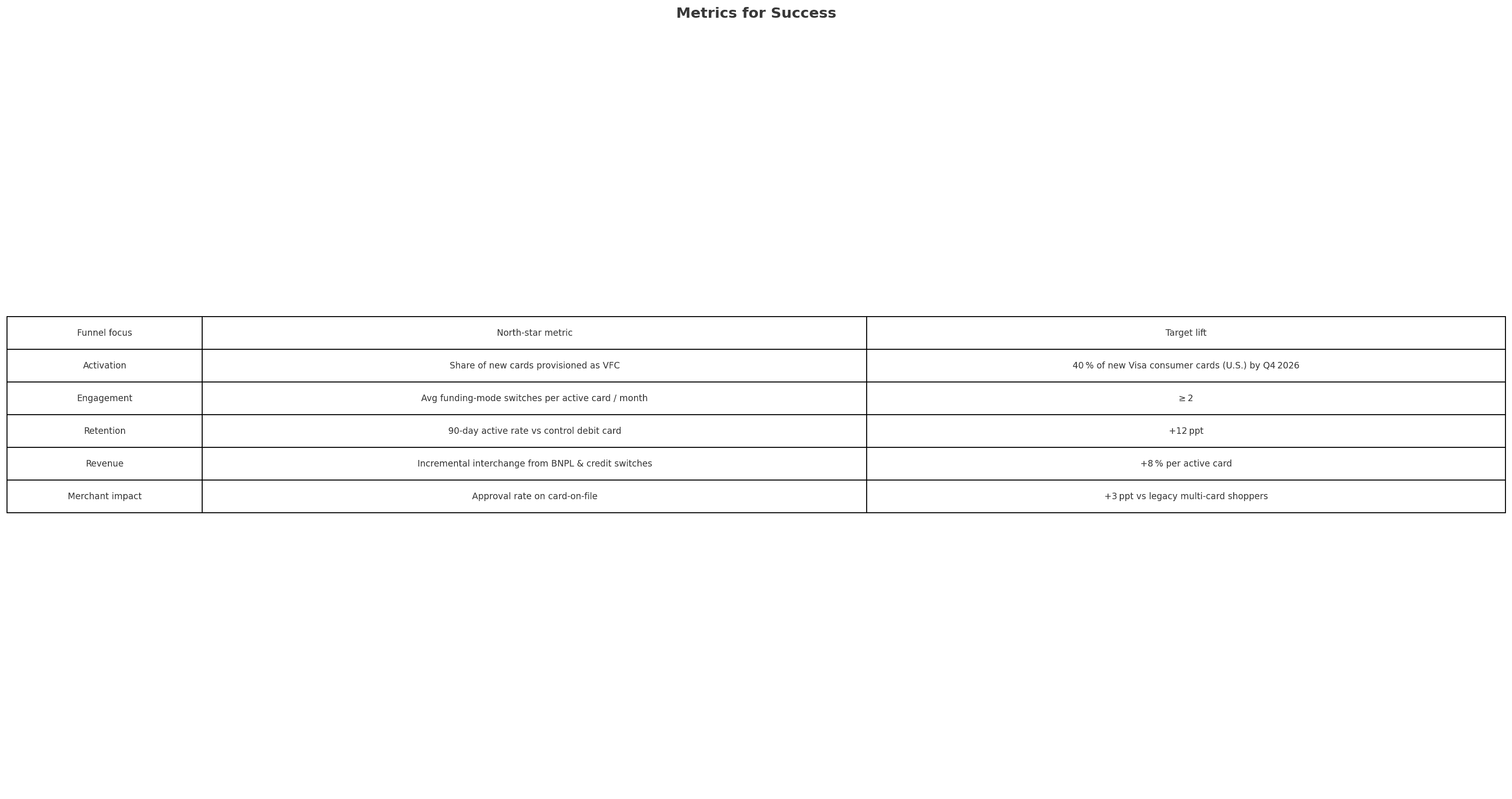

Metrics for Success

Please click on the picture to zoom in !

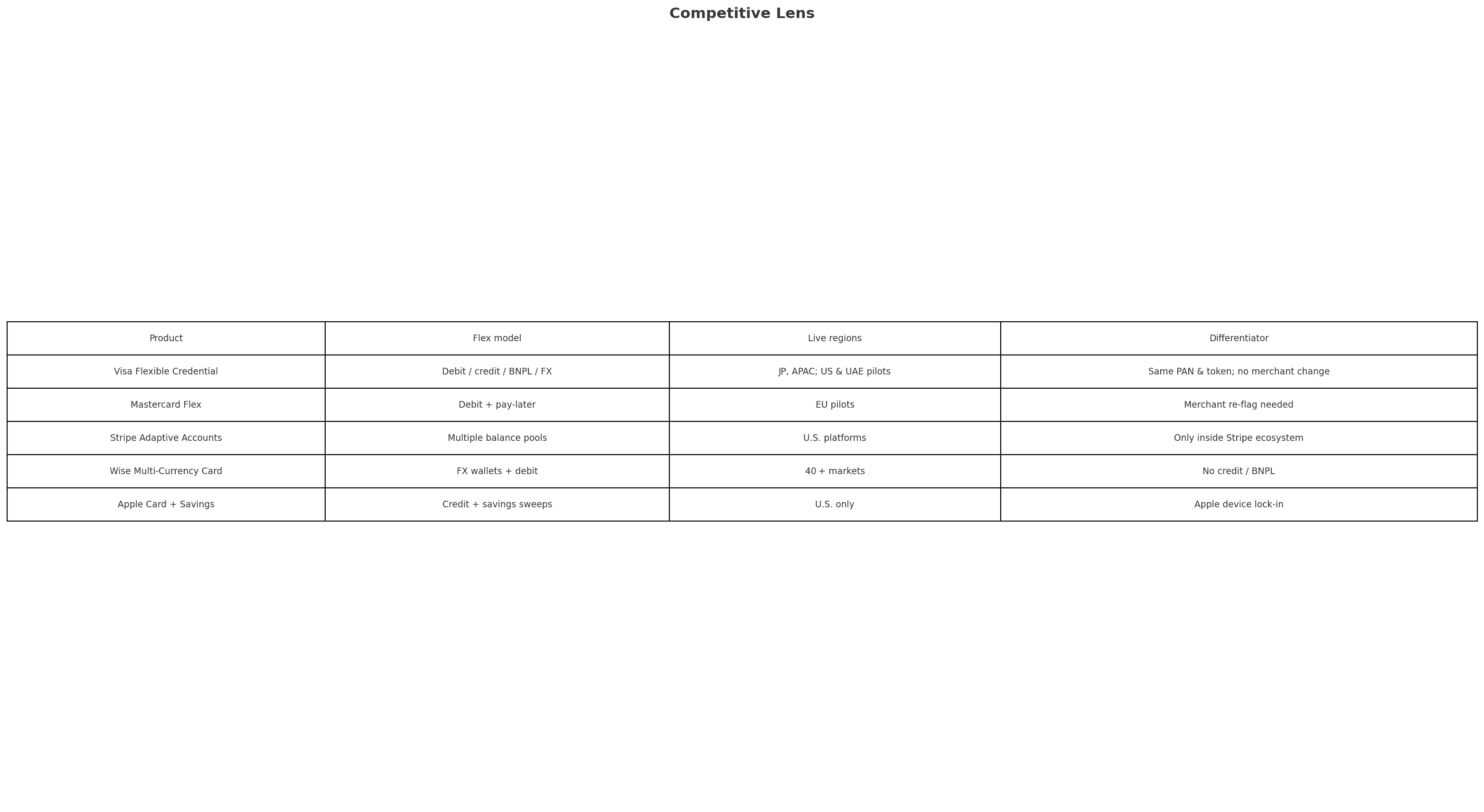

Competitive Lens

Please click on the picture to zoom in !

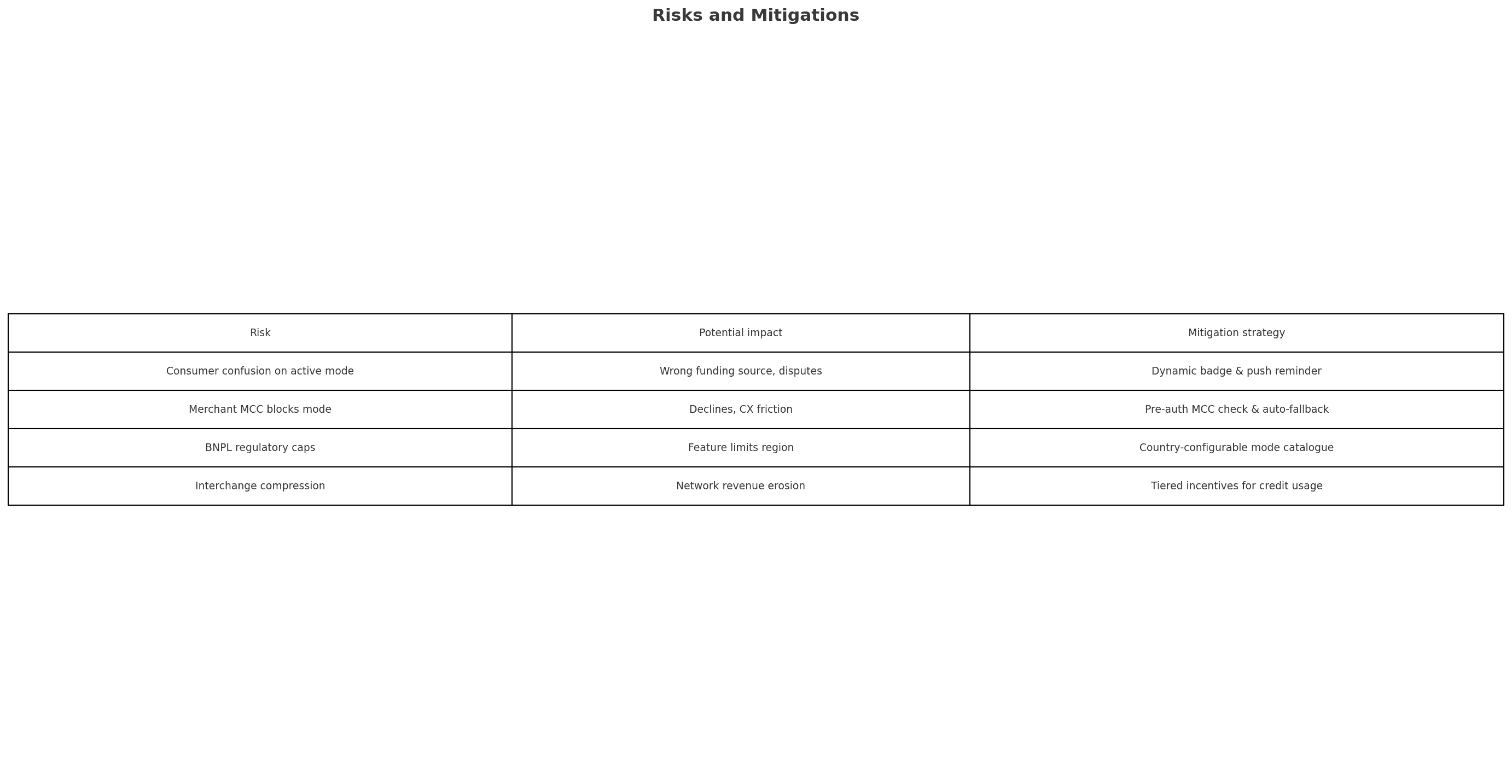

Risks and Mitigations

Please click on the picture to zoom in !

Final Take-away

Visa Flexible Credential already demonstrates that a single Visa number can satisfy debit devotees, BNPL fans and global travelers—without new hardware or merchant re-work. As a product manager I would now:

Scale issuer SDKs so any bank can toggle on VFC inside its app in weeks.

Ship after-purchase switching to tackle the biggest user “oops” moment and drive incremental interchange.

Instrument uplift through approval-rate analytics and card-on-file token survival.