Mastercard Send, Real‑Time Payouts – Product Teardown

Case Study

One‑liner: Make instant payouts predictable, measurable, and easy to build, so money reliably lands “in minutes” across cards, accounts, and wallets.

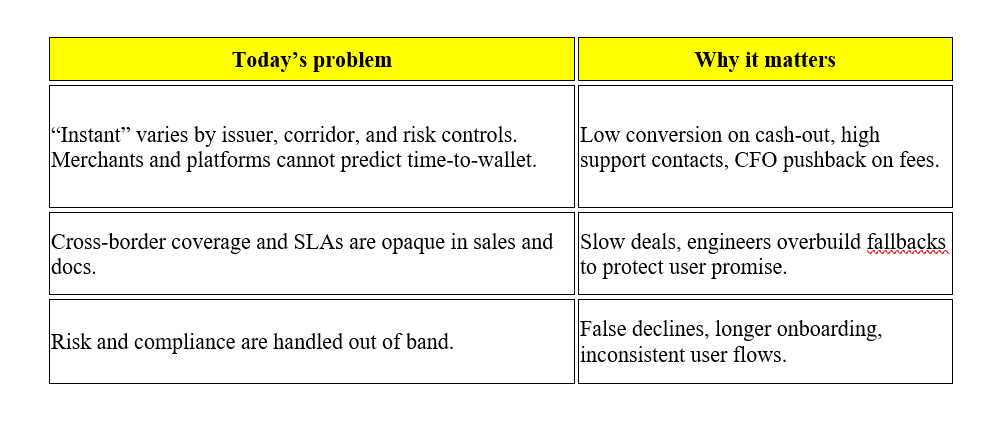

Problem and goal

Goal: Increase payout adoption and satisfaction by making time‑to‑wallet predictable and transparent, while reducing build time for partners.

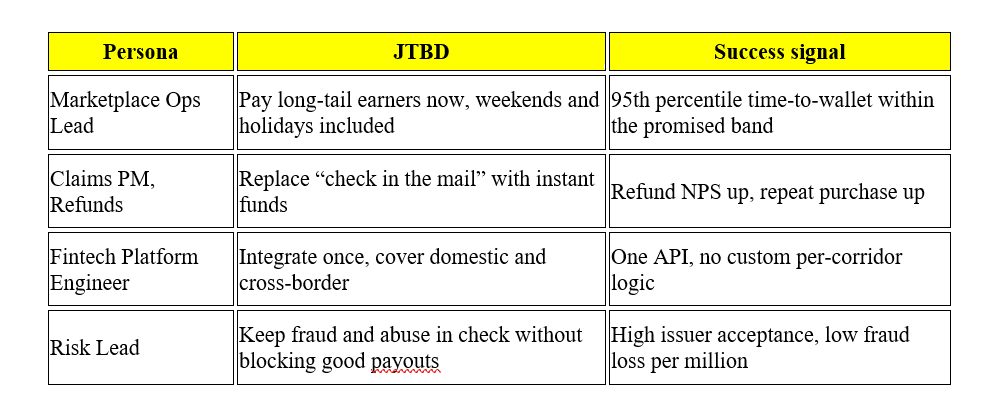

Users and Jobs‑to‑Be‑Done

Product vision and north star

Vision

Send is the fastest way to put money in a customer’s hands, with corridor‑level predictability and a single builder experience.

North star

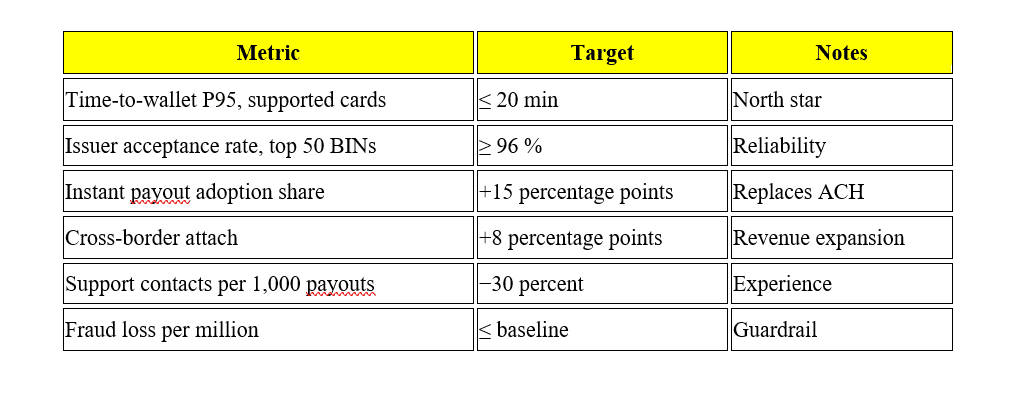

P95 time‑to‑wallet within 20 minutes on supported cards, with ≥96 percent issuer acceptance on top corridors.

Strategy, three product pillars

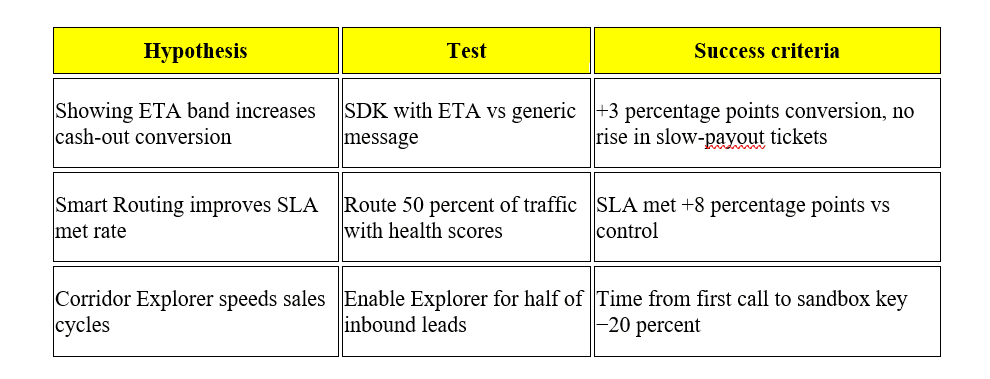

Predictability

Surface live corridor SLAs and issuer health, set clear customer promises, route around problems.Control

Expose policy, risk, and fee controls in one console, give finance real cost and SLA views.Ease

Shorten partner build time with a UX SDK and simple API shapes, reduce custom code.

PRD summary, the three core features

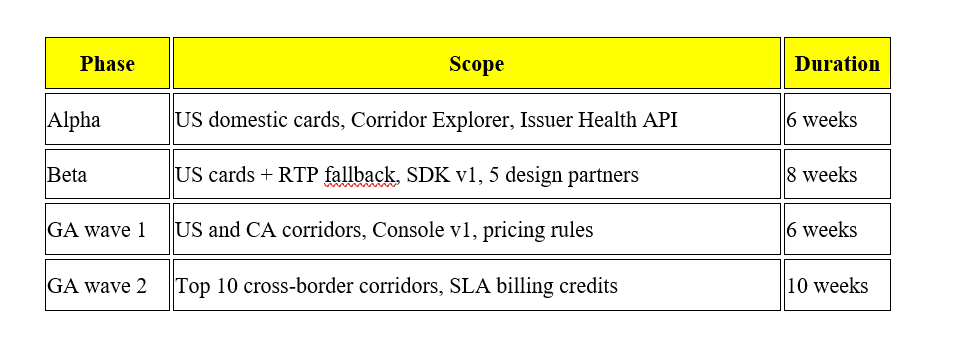

A. Corridor Explorer, public and embeddable

Problem

Partners cannot see which corridors, payout types, and SLA bands are available.

Solution

A searchable map and API that returns corridor, payout types (card, account, wallet), P50 and P95 time‑to‑wallet, fee range, weekend coverage.

Key user stories:

As a sales engineer, I can show a prospect live SLAs for US→US and US→CA cards.

As a platform, I can query an API for corridor capabilities at checkout.

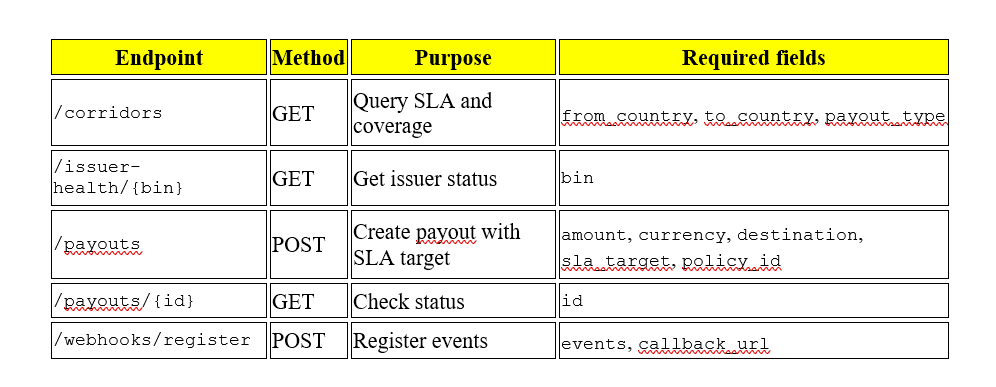

Acceptance criteria:GET /corridors?from=US&to=CA&type=card returns p50, p95, fee_min, fee_max, availability_hours.

Data is refreshed at least hourly.

Regions without coverage return a structured, cacheable error.

Analytics

Search to integration rate, top corridor requests, abandonment where coverage is missing.

B. Issuer Health and Smart Routing

Problem

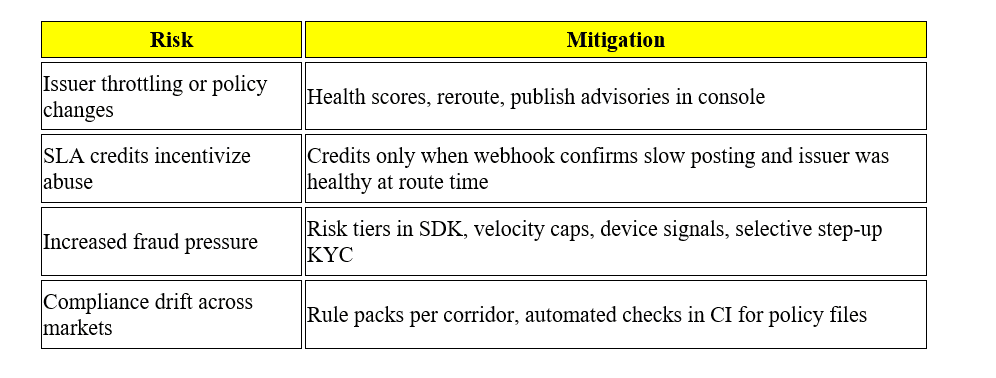

Issuer controls and outages create variance and declines.

Solution

An internal health score per issuer BIN with live status and a routing policy that chooses the best rail, with optional fallback to ACH or RTP if the promise cannot be met.

Key user stories

As a platform, I want Send to avoid issuers where card posting is slow today.

As risk, I want velocity and spend caps by issuer and merchant category.

Acceptance criteria

POST /payout accepts sla_target=20m, returns route=card or route=rtp plus expected_p95.

If the SLA cannot be met, the API returns alternatives with expected time and fees.

Merchant policy can lock routing to certain rails.

Analytics

Acceptance by issuer, reroute rate, met vs missed SLA, false decline rate, fraud loss per million.

C. Partner Console and Risk‑aware UX SDK

Problem

Partners rebuild the same payout UI and policy logic, onboarding is slow.

Solution

A console for fee rules, KYC tiers, and policy, plus a drop‑in UI that handles fees, bank card capture, and real‑time status. Webhooks keep platforms updated.

Key user stories

As a PM, I can set who pays the fee and cap it.

As a developer, I can drop in a prebuilt “Cash out now” component and ship in days.

Acceptance criteria

SDK component renders fee, ETA band, and status.

Webhook events: payout_queued, payout_posted, payout_failed, payout_slow.

Console exports issuer and corridor reports to CSV.

Analytics

SDK adoption rate, time‑to‑first payout, support tickets per 1,000 payouts.

API surface, first draft

Core objects, minimal fields

Payout: id, amount, currency, destination_type, masked_pan_or_account, route, submitted_at, expected_p95, status, posted_at, fee, sla_met:boolean.

IssuerHealth: bin, status, acceptance_rate, p50, p95, last_updated.

Corridor: from, to, type, p50, p95, fee_min, fee_max, hours.

System flow, high level

Client calls /payouts with sla_target=20m.

Router checks IssuerHealth, corridor SLA, and merchant policy.

Route selected, example card push, else RTP fallback if SLA cannot be met.

Webhooks fire status events, console updates SLA met vs missed.

Analytics pipeline aggregates issuer acceptance and time‑to‑wallet.